August 15, 2024

Empowering Employees with Real-Time Wage Access: The Future of Payroll Management

With inflation at a 30-year high, millions of Americans face significant financial hardship between pay periods. The rising cost of rent, groceries, transportation, and other essential expenses often forces many hourly workers to rely on credit to make ends meet until their next earnings. A recent study¹ found that 50% of hourly employees have no emergency savings, and almost 80% have less than $500 in savings.

What if team members could access their wages instantaneously? How would this impact their lives? Imagine an employee finishing a long shift and being able to request payment for those earned wages immediately, rather than waiting for the next payday. This option, known as Earned Wage Access (EWA) or on-demand pay, allows access to accrued net pay before the scheduled payday. Unlike advances or payday loans, EWA provides readily available funds to cover bills or unexpected expenses.

EWA fosters a culture of trust in the workplace. It offers flexibility in compensation, strengthens the bond between employers and team members, and provides greater control over finances. This increased financial control can enhance team motivation and productivity. By mitigating the financial strain of living paycheck-to-paycheck, EWA reduces staff’s vulnerability to predatory practices and short-term payday loans, which often lead to a cycle of debt. Financial and emotional stress directly impacts productivity and long-term corporate earnings.

Employers should consider including EWA in their employee benefits package. It represents a transformative approach to payroll management. In today's competitive job market, where attracting and retaining talent is increasingly difficult, EWA could be the solution.

Veep's Approach to Enhancing Employee Pay Flexibility

Veep is an innovative software solution aimed at eliminating predatory practices and short-term payday loans while facilitating Earned Wage Access (EWA) for hourly workers. This is how Veep helps employers boost workforce stability and minimize turnover. The platform leverages Veep's proprietary HR retention and banking payment network to strengthen employee engagement. Team members gain access to earned wages in real time, at a significantly lower cost, through a secure, regulated community banking network.

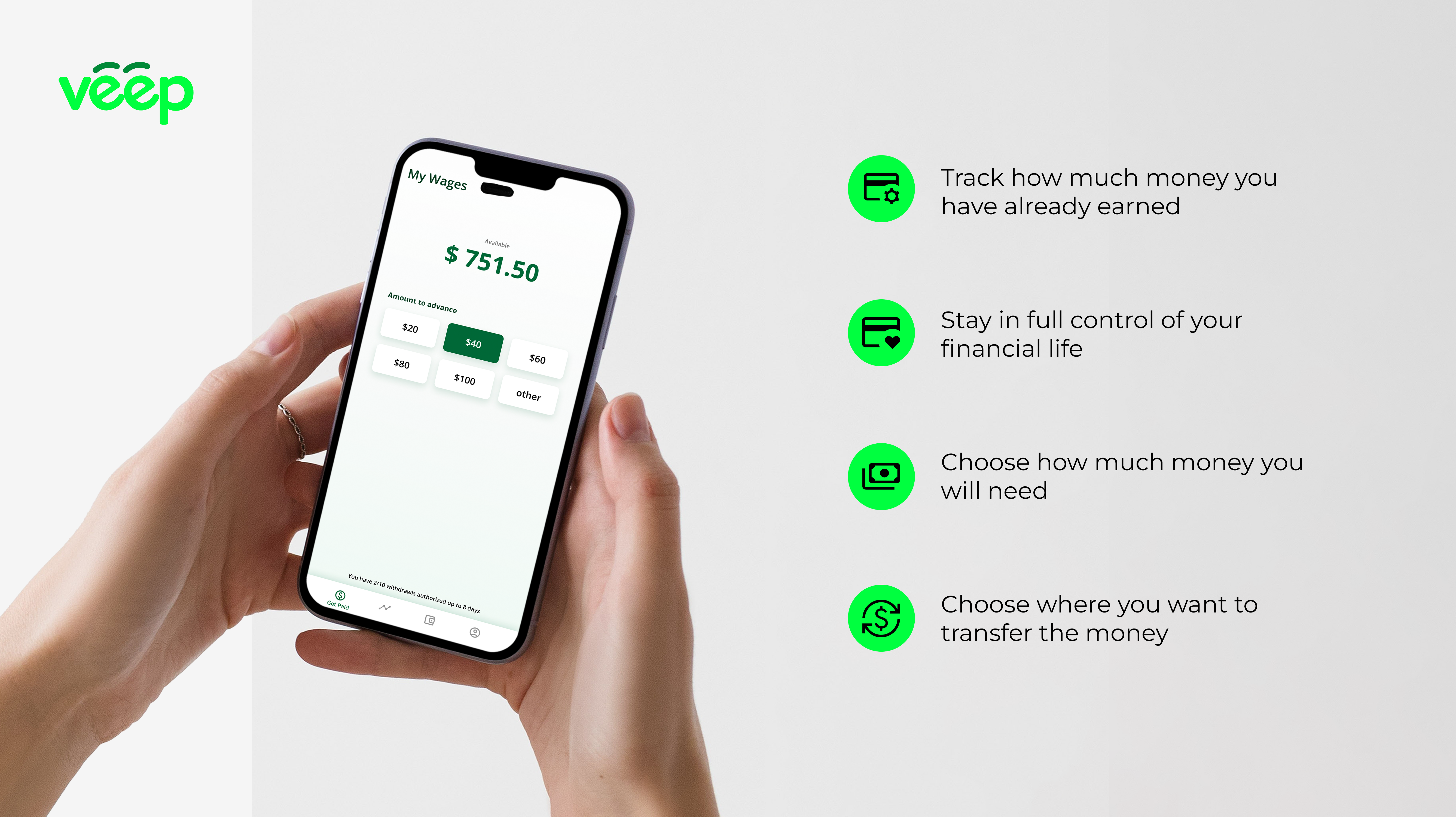

Veep provides users with a range of essential features to manage their finances more effectively. Employees can track how much money they have already earned and monitor their financial activity to determine the exact amount of money they can request. They can choose the amount of money they need, within the limits specified by their employer, and request funds without delays or transfers. The platform also offers a comprehensive history of all transactions, ensuring users stay in control of their financial lives.

Veep not only helps staff manage their cash flow needs between pay periods but also supports them in making informed financial decisions. This capability helps avoid unplanned fees, reduce financial stress, and increase life flexibility. By encouraging referrals and keeping users engaged and motivated, Veep fosters a more stable and productive workforce. This creates a mutually beneficial scenario for both employees and employers.

Click here to learn more about our product

Study¹: Branch 2022 Report on Hourly Workers